Why Turnover Growth Often Hides Profit Problems (And What Business Owners Miss)

Turnover growth feels like success.

More sales.

More customers.

More activity.

But one of the most dangerous assumptions in business is this:

“If turnover is going up, we must be doing well.”

In reality, many UK businesses grow turnover while profits quietly shrink.

And by the time it’s obvious, the damage is already done.

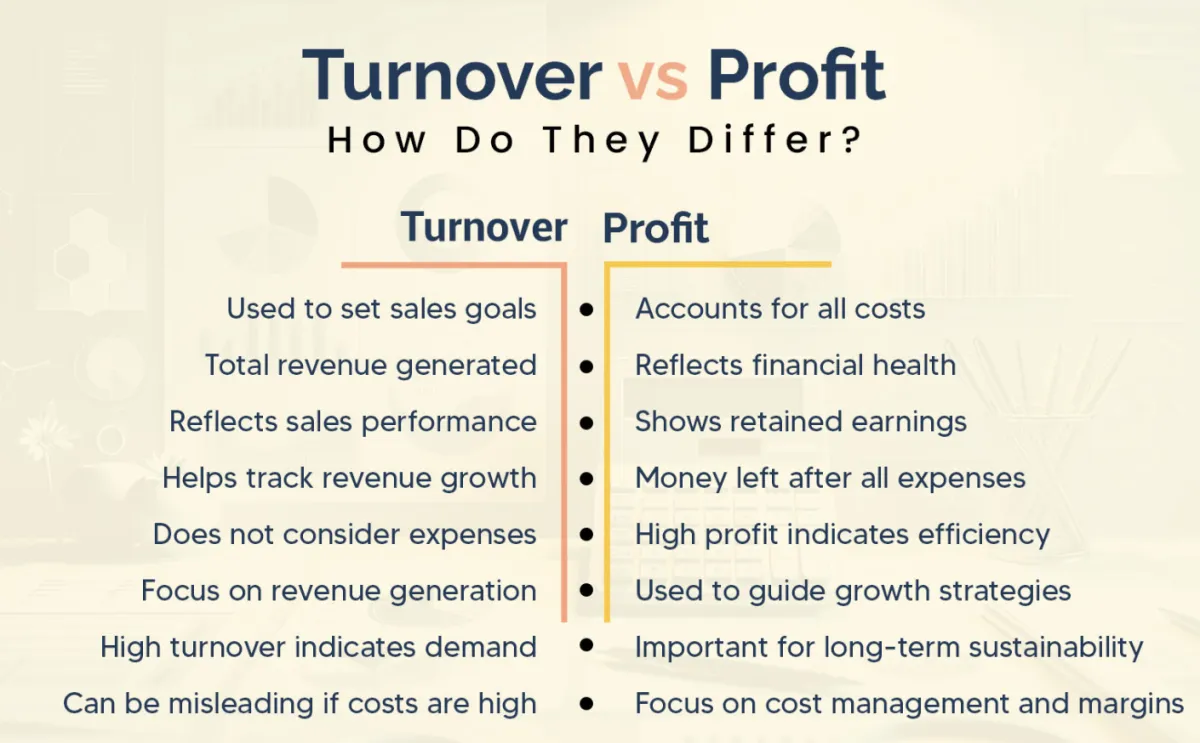

Turnover Is Easy to See. Profit Is Not.

Turnover is visible.

Sales increase

Bank activity increases

The business feels busy

Profit is quieter.

It hides in margins

It’s affected by costs, pricing, and efficiency

It only shows clearly with good bookkeeping and reporting

Without clear numbers, business owners mistake movement for progress.

The Most Common Ways Growth Destroys Profit

Here’s what we see repeatedly when businesses scale without control.

1. Pricing Doesn’t Keep Up

Discounts creep in.

Margins erode.

“We’ll make it up on volume” becomes the plan.

It rarely works.

2. Costs Rise Faster Than Revenue

New staff.

More software.

Higher overheads.

More complexity.

Turnover grows, but fixed costs grow faster.

3. Inefficiency Is Hidden by Busyness

More work hides poor processes.

Mistakes increase.

Rework becomes normal.

The business feels productive, but profitability suffers.

4. Owner Time Becomes the Free Resource

Founders plug gaps.

Longer hours mask inefficiency.

True profitability is overstated.

This is invisible without proper analysis.

Why Annual Accounts Miss This Completely

Statutory accounts tell you what happened last year.

They don’t tell you:

When margins started slipping

Which customers or services are unprofitable

Where growth is hurting cash and profit

That’s why businesses can look “successful” on paper and still feel fragile.

Control Comes From Understanding Margins, Not Just Sales

Profit problems aren’t fixed by more turnover.

They’re fixed by:

Knowing your gross margins

Understanding which work makes money

Seeing cost trends early

Reviewing numbers regularly

This requires:

Consistent, accurate bookkeeping

Management reporting, not just compliance accounts

Numbers explained in plain English

Without that, growth is guesswork.

Why This Matters for Exit Value

Buyers don’t pay for turnover.

They pay for quality profit.

A business with:

Strong margins

Clear reporting

Predictable profitability

Is:

Lower risk

Easier to scale

Worth more at exit

A business with rising turnover and falling margins is a red flag.

Final Thought

Turnover growth feels good.

Profitability keeps businesses alive.

If your business is busier than ever but doesn’t feel financially stronger, the issue isn’t ambition.

It’s visibility.

When business owners gain control of their numbers, growth becomes intentional and profit becomes predictable.

That’s when businesses become truly valuable.